It’s either a hurricane, fires, or your personal identification being breached and stolen from the country’s biggest credit reporting agency, Equifax. All of these are total disasters and we need to prepare accordingly. My prayers are for protection and peace for each and every person effected by these disasters. However, since my expertise is in credit, I’m going to focus on sharing some information that will help you weather the storm, be prepared, and stay protected from a very potential life changing event.

I’ve had several clients call in with concern – and rightfully so – regarding the Equifax breach and what they should do about it. With this post I hope to reach all our past and current clients, as well as non clients, with this important information and I apologize for not getting it out a bit sooner. https://youtu.be/uohoyL4AvhQ

What happened exactly? Millions of Americans’ personal information has been breached and someone (or many individuals) now have the exact information we all use for day-to-day financing. This includes social security numbers, birth dates, addresses, and who knows what else. This disaster doesn’t just pass and rebuild in a couple of years. Unless you can completely change your identity, like your social security number and date of birth, this will expose us for the rest of our lives.

Let’s consider that your information has been breached and is currently in the wrong person’s hands. This means that your information may have already been sold back and forth through the black market. Let’s also consider the fact that the major bureaus have already been selling your information for years legally to various marketers. When I was in the car business, we frequently bought this information for advertising reasons. And of course, as you guessed, the biggest marketer buying this information today are collection agencies. This is just one reason, out of many, that you should option-out with the credit bureaus. (Click here for my blog “Staring Down the Barrel of a Trigger Lead) But for now, let’s focus on the problem in front of us.

How can this effect you? With your information in the wrong hands, it’s apparent that your identity can be used to obtain credit lines that will destroy your credit and expose you to the nightmare of defaulted credit. In addition, all of your personal accounts (such as: checking, savings, 401 K’s and any online accounts) can now be exposed with this information on the loose. This is not like a debit card that we can get credited back from the bank then simply replace with a new number. This could be devastating and your identity exposed indefinitely!

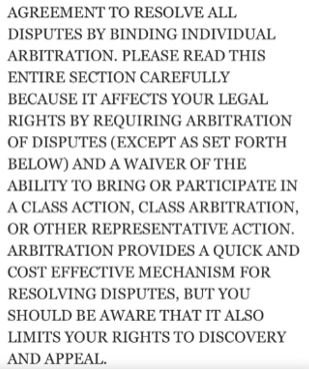

Equifax finally responds and will offer the consumer a one-year free monitoring subscription, allowing members to check and monitor any activity on their credit. However, this is only a partial solution. Let’s not forget the fine print here – signing up with their free program will also waive your rights to sue the company for any damages. The image to your left below is a screenshot I took from their Terms of Service.

Here is the relevant passage of the Terms of Service, buried deep in legal jargon of the peace effort Equifax is making with the free monitoring:

You are waiving your rights to sue.

Also when you sign up for their free monitoring, they require even more personal info. Pretty scary! “Oh sure! Here you go – not only have I been exposed, but now I get to wear transparent underwear!” Besides, outside of waiving your rights to seek damages, this is only a partial and temporary solution to help monitor against future credit lines from being opened in your name. It does nothing to protect your personal accounts and other factors that require your identity – plus, it’s only for a year. This is a life-time problem!

What can you do? There are plenty of credit monitoring companies out there that will help. I recommend using Credit Karma as it is free and they will notify you as soon a change hits your credit. This includes inquiries from a potential creditor which allows you time to immediately disrupt the theft as opposed to finding out much later. However, this only protects your credit.

Your next step is to create a complete inventory of your personal finances. Include checking and savings, retirement plans, insurance plans, etc. and any type of account that might be set up via internet or online shopping. Then, demand extra layers of security from each one. If you can simply call or go online to access an account using a social, dob, or address history then that account is no longer safe and secure! You must have additional layers of security on your account. These may include pin numbers, a series of personal questions that only you would know the answers, or the most popular one today – the security code sent to your personal mobile device. If these companies are not being proactive in securing your accounts then pull your funds and go to someone that is!

Your final step is to monitor the activity on all of your accounts. Look at and question each transaction. Pay special attention to even the smallest debits. I, personally, was hit a few years back when my business debit card was hacked. Since the scammer was pulling smaller reoccurring amounts, it was months before I figured out what was going on! By monitoring and questioning transactions, you can help reverse and stop a potential problem right away.

Above all else – don’t panic! Be diligent as you monitor your accounts. This along with the suggestions I’ve given above, will help prevent irreversible damage in this disaster. Create positive habits as these solutions must be a lifestyle change. This is not something that we do just until the storm passes but something we need to do for the rest of our lives. Remember, unless you change your identity, the identity you have today is the same one that the thief will have 10 years from now. -Dennis Hubbard

Did I say “not to panic”? As scary as that thought is – don’t.

“We’re in the business to change lives!”

- Fico Exposed - December 9, 2017

- Making Payment Arrangements on Old Bad Debt - September 13, 2017

- Positive Versus Negative Credit - September 12, 2017

Call Now: (806) 576-4995

Call Now: (806) 576-4995