It seems reasonable to assume that having multiple paid accounts or paying off a large loan (such as a forty-thousand-dollar vehicle or mortgage) would be enough to overcome the bad credit of our past. We’ve heard it time-and-time again from bankers, anti-credit repair financial advisers, and even from the media’s so-called financial experts – “If you just pay your bills on time then you will have good credit.” How many times a day does a car salesman tell their clients that if they make their payments on time for a year that they’ll qualify for a better interest rate and to refinance? Or that they might be able to trade-in for something at a better rate?

Let’s fast forward a year – you’ll see that this client is still at a D-Tier credit rating. I’ve run into guys that have made every payment on-time with some even making double the payments on their loan. They may have even paid their loan off early thinking that any of the above should have given them a good credit score. This sounds pretty reasonable but it is not this simple. Unlike what this pompous advice would make it seem.

Although important, on-time payments only play a small part in your overall credit rating.

Paying everything on-time is a great credit restoration plan… IF you want to wait SEVEN years and pay God-awful interest rates on whatever loans you qualified for at the time! Let me explain using the example pulled from a credit report below:

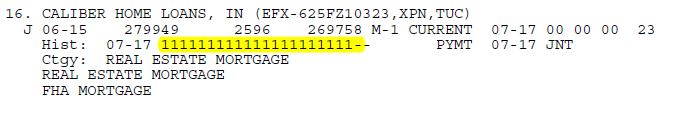

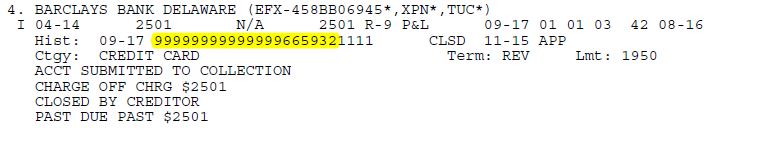

When you make a payment on-time each month, it gets marked with a 1. (Notice the highlighted area)

A defaulted loan, however, gets marked with a nine and updates every month.

These factors contribute to your payment history which makes up to 45% of the credit score. For every positive mark you get by paying on-time each month, there are 9 marks taken off for each negative account. If you are trying to re-establish your credit worthiness by just paying off your new loans on time then you really need to consider this when comparing the good to the bad.

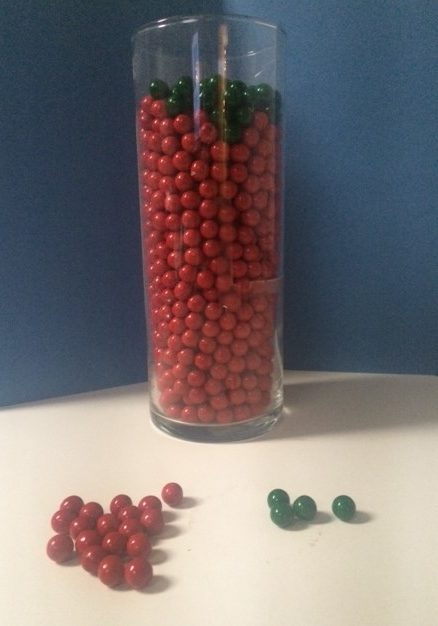

Let’s add some graphics into the mix here. If I add 9 red beans to the jar for each 9 I see on the report then that’s 240 red beans per negative account. If I have ten derogatory accounts then that will add up to about 2,900 red beans in our jar. Now, we’ll add a single green bean for every on-time payment made within the last 24 months. If you only have three positive accounts, that’s only 72 green beans in the jar. You see it now, right? That jar is predominately red! It will take a ton of on-time payments to make up the difference!

Also, please note that regardless of the amount or type of loan the status stays the same. You get 1 mark for a positive account and 9 for a collection or charge-off. Now I know that I teach how the age of an account etc., contributes differently based on the date of the derogatory. But in this scenario, I am strictly speaking of a true comparison between good versus bad credit.

So, let’s cut through what seemed like good ole’ common sense and sound advice. Yes, pay your bills on time! Not because it will greatly contribute to redeeming your credit score, but because not paying them on-time will KILL your credit score.

Also, Paying extra does NOTHING as you’ll still get the same positive 1 mark (and one little green bean) for that month. But what about paying off early? It’s the same – just one positive mark. So should I go and get a bunch of extra loans? NO! That will hit you negatively for multiple accounts in a recent period of time.

As a child, I was one of five boys and my parents were very strict and disciplined with their money. We were given a set allowance and any asking for money on-the-fly was unheard of. I remember needing extra money once for an upcoming event so I concocted the perfect plan. I’ll make sure all my chores are finished, won’t get into any trouble that week, do all my school work, and then ask for the well-deserved extra funds. At the end of the week, I went to my father and plead my case. All the while, I pictured him happily handing over the extra cash with overwhelming gratitude. Boy was I wrong!

He said to me, “Why would I pay you extra money for doing what you are supposed to do?

I think my father had something to do with writing the credit score algorithm! Seriously though, in the same way the credit score doesn’t give you much for doing what you are supposed to do (i.e. “Paying your bills on time”), if you don’t do what you are supposed to then the consequences can sting.

Then, what should we do? Clearly, we have to show new credit and pay everything on-time. However, that is just the first step. You also need to add the RIGHT kind of positive credit and optimize it – that’s called utilization. Lastly, you’ll need to remove the negative but simply paying off the old debt is not the answer – Read Settling Old Bad Debts and How it Effects your Score here. It is way more complicated than that. Paying off most of your old derogatory accounts will only re-age them and drop the credit score!

Call us for a free consultation and we can discuss the best options that will help re-establish your credit worthiness and optimize your credit score – in the absolute fastest way possible! And when I say you, I mean exactly that – what might be the answer for one person will most likely be different for the next. I look forward to hearing from you!

“We’re in the business to change lives!”

- Fico Exposed - December 9, 2017

- Making Payment Arrangements on Old Bad Debt - September 13, 2017

- Positive Versus Negative Credit - September 12, 2017

Call Now: (806) 576-4995

Call Now: (806) 576-4995